The year 2022 has witnessed major economic and political events, the most popular of which was the Russia-Ukraine war. The war in Ukraine has overwhelmed the country and sparked economic insecurity around the world. The war’s repercussions and its global concerns on the global economy were the main drivers for gold purchases for the year.

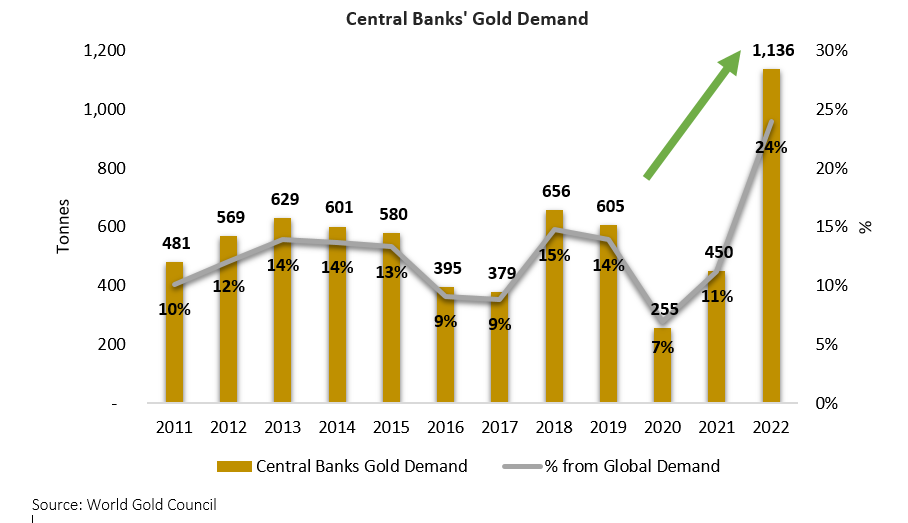

Gold demand from global central banks shapes the gold market in 2022, as they bought the most gold on record last year. The World Gold Council (WGC) announced that central banks added an enormous 1,136 metric tonnes of gold worth about $70 billion to their reserves in 2022, by far the most of any year in records going back to 1950. The accumulated yellow metal in central banks’ stockpiles in 2022 represented a 152% increase compared with 2021’s 450 metric tonnes. Indeed, central banks nowadays hold more than 35,000 metric tonnes of yellow metal, or around a fifth of the total amount of gold ever mined.

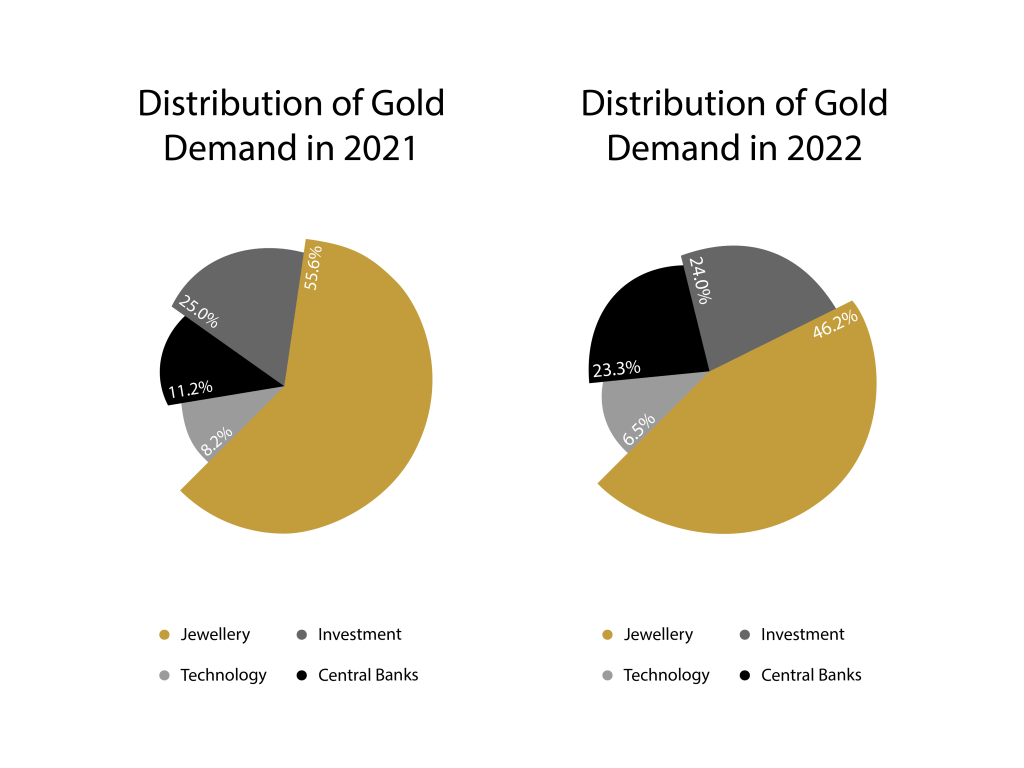

The percentage of the central bank’s gold demand from the total gold demand has increased to about 24% in 2022, compared with only 11% in 2021 and 7% in 2020.

Why do central banks buy gold?

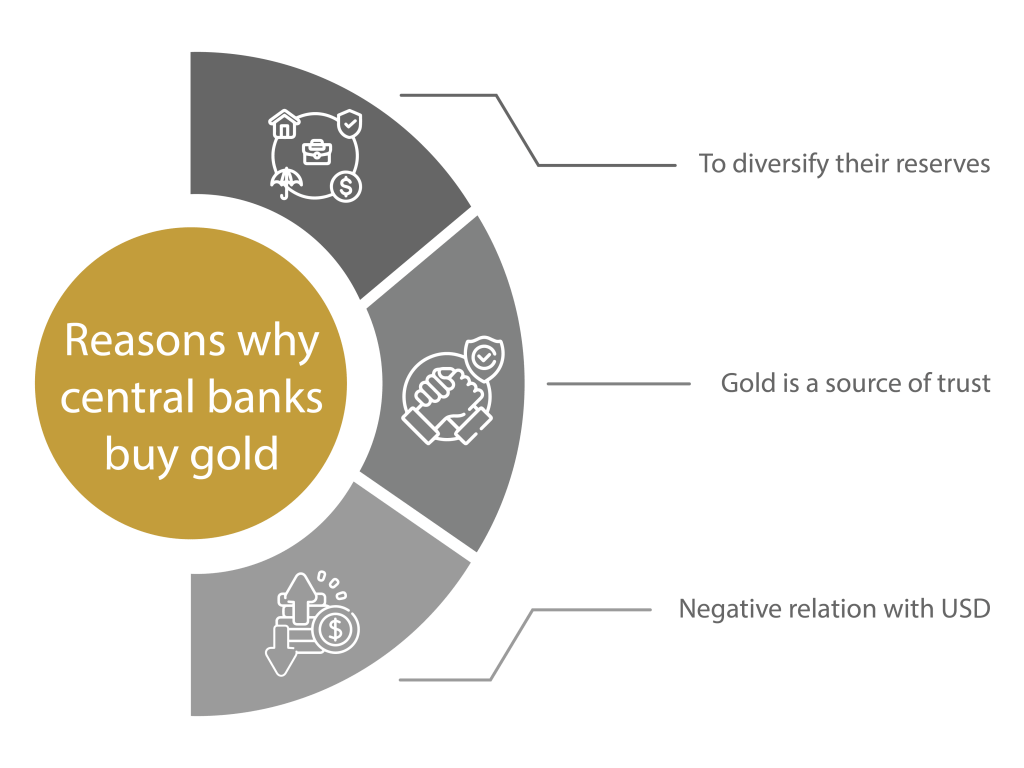

The WGC answered this question in a recent report. It tried to explain why gold has been such a key asset for so long. The report said that the main role of gold for central banks is to diversify their reserves. Central banks are responsible for stabilizing their nation’s currencies, which are subject to fluctuating values depending on the apparent strength or weakness of the underlying economy. If central banks took the decision of printing more money, which means increasing the money supply, this would come at the expense of devaluing their own currency. Gold, by contrast, is a finite physical commodity whose supply can’t easily be increased. As such, it is a natural hedge against inflation, according to the report.

The WGC report added that central banks increased their gold reserves as it serves as a source of trust in a country in any of its economic situations.

Another reason is that gold has a negative relationship with the US dollar, which is another component of the central bank’s reserve. This relationship ensures that when the dollar declines in value, gold, on the other hand, usually rises, enabling banks to protect their reserves from volatility.

Analysts said that they are expecting high inflation across most of the global economies, making gold a good asset for demand. They added that concerns over low expectations given the declining inflation this year will likely keep demand for gold on a firm footing.

Increasing concerns about a possible global financial crisis, with anticipated changes in the international monetary system and concerns over rising economic risks in reserve currency economies, are the main reasons for central banks’ plans to increase gold demand, according to the 2022 Central Bank Gold Reserves survey.

What about the demand from the Central Bank of Egypt?

The Egyptian Central Bank bought 44.4 tonnes of gold in February 2022. It positioned it as the largest purchaser of gold among central banks in the first quarter of the year. According to WGC, the volume of gold at the Egyptian Central Bank increased by 55% to surpass 125 tonnes at the end of February, or about 19.4% of the total country’s foreign currency reserve.

Egypt succeeded in increasing its gold reserves at the Central Bank of Egypt (CBE) during 2022 to come in third place worldwide, following the Central Bank of Turkey and the People’s Bank of China, respectively.

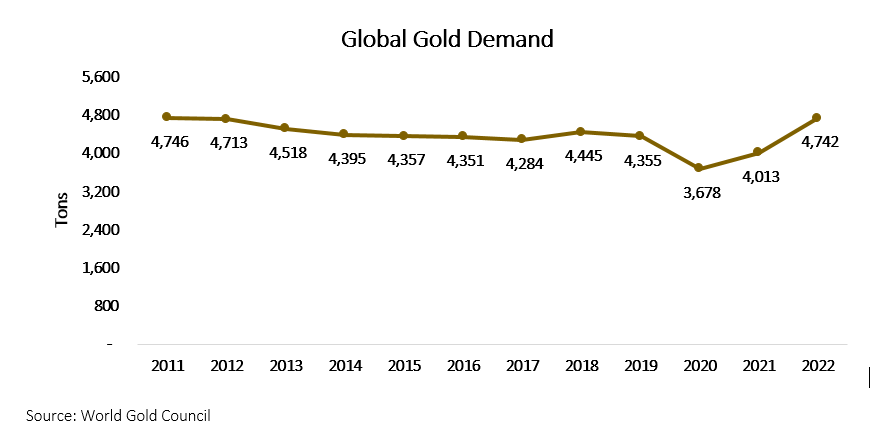

2022: the strongest year for gold demand in a decade

In general, gold demand surges to its strongest level in more than a decade in 2022, according to the WGC. It surged 18% on a yearly basis to hit 4,741 tonnes in 2022, the highest annual total demand in a decade. Purchases of central banks are the main driving forces behind this growth.

Gold bars and coins sustained to be popular with investors in numerous countries around the world, mainly the Middle East, where demand rose by 42%.

From the above graph, it can be seen that the demand of global central banks has increased at the expense of global gold jewelry, as the percentage of jewelry has decreased from 55.6% in 2021 to 46.2% in 2022. While the percentage of the central bank’s gold demand has increased dramatically from the total demand to 24% in 2022, compared with 11.2% in 2021,

Demand for jewelry relaxed slightly in 2022, down 3% at 2,086 metric tonnes, mainly driven by the noticeable drip in annual jewelry demand from China, down 15%, as consumer purchases were reduced by continuing COVID-19 lockdowns for most of the year, according to WGC.

Also, the continued gold price increase in the fourth quarter of the year has helped in the annual decline in jewelry demand, according to WGC.

Demand for gold coins and bars in Egypt rose by 83% in 2022, according to the WGC. A mixture of high inflation, currency weakness, and political unrest combined to increase the attraction of paper money toward gold.

Rush on Gold in the Year: Main Reasons

In times of crisis and turmoil, gold serves as a safe haven and is sought after by buyers. A safe haven is a term that refers to an asset that is projected to preserve or increase in value throughout times of economic downturn. Gold may be by far more efficient than cash when considering storing wealth. When inflation is on the table, the cash may have actually lost value. Gold is known for having a long-term record of stability.

Gold prices rose above $1,900 on February 17 for the first time since June as investors flocked to the safety of bullion after U.S. President Joe Biden said there was every indication Russia was planning to invade Ukraine.

It is worth mentioning that Russia is one of the world’s largest producers of the precious metal.

The commentary on the reasons behind the increased gold demand in 2022 from the WGC said that it was mainly driven by the central bank’s demand and the demand for bars and coins. It elaborated that the high inflation prompted gold bar and coin investment. Generally, gold holdings are at their peak because of their role as a long-term source of value and their performance during times of crisis.