Gold prices clocked their first weekly decline in four last week, with participants preparing for the Federal Reserve’s last policy decision for 2023 this week to get clarity about U.S. interest rates trajectory next year.

While the Fed is widely anticipated to hold borrowing cost at the current 5.25%-5.50% range, markets will keenly monitor remarks Fed Chair Jerome Powell, along with the latest economic projections, most notably the breakdown of individual FOMC member’s interest rate forecasts.

Recently, markets have stepped up their bets for the start of rate reductions in March, owing to the steadily fall in inflation toward the Fed’s objective of a 2% annual rate.

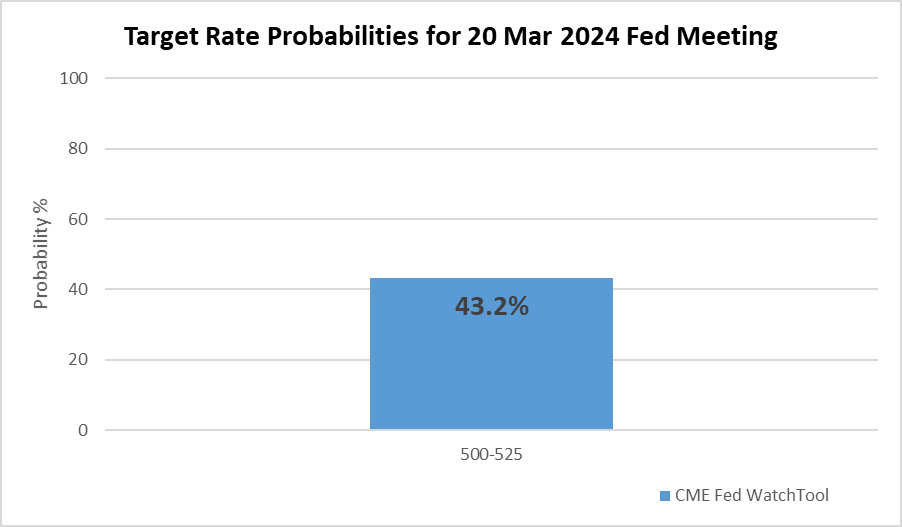

Meanwhile, markets price in a 43.2% chance the Fed would cut its rate at its meeting in March, up from a probability of 12.4% a month ago, according to the CME FedWatchTool.

However, Powell may push back hardly against growing bets of rate cuts early next year, as he noted last month that it was “premature” to speculate rate cuts and stressed that the Fed could even raise rates if inflation deviates away from the Fed’s goal.

In September, Fed officials predicted one more rate hike this year, whilst they also expected just half a percentage point worth of cuts in 2024. Yet, things have changed dramatically since September, as the Fed left rates steady at 22-year high for the second time in a row in November and most probably will hold rates on December 13.

It is worth mentioning that investors will not only focus on Fed’s decision, but also a slew of high-relevance data from the United States, including both consumer and producer inflation, retail sales and preliminary PMI manufacturing and services.

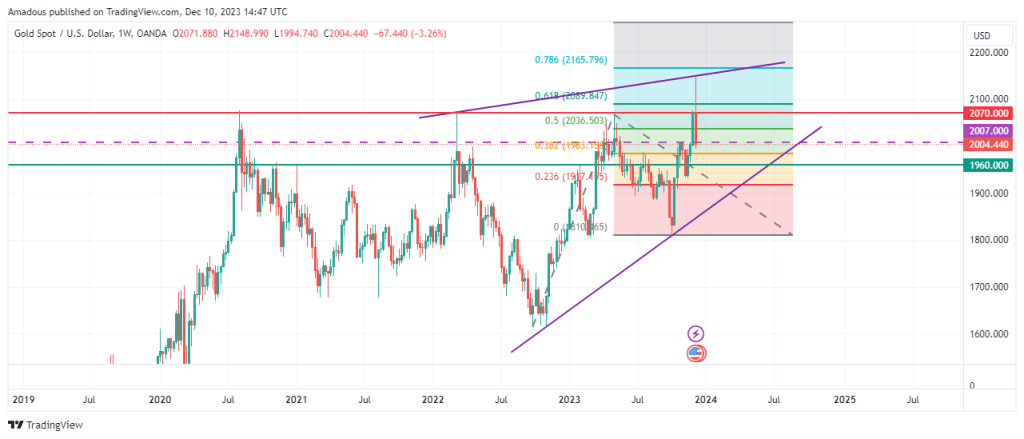

Key Levels to Watch for Gold This Week

After hitting an all-time high at $2148 an ounce at the beginning of last week, gold retreated to finish the week 3.25% down, following data released on Friday showing the U.S. labor market unexpectedly strengthened in November, which deflated bets the Fed will slash rates in the first quarter of 2024.

Gold prices closed at $2004 on December 8, which is below this week’s pivot point calculated at $2007. Therefore, gold could resume its drop to test the psychological level of $2000, noting that its break would send prices lower towards $1983, which represents 38.2% Fibonacci extension level, then monthly support at $1960.

On the other hand, shall gold rebound from $2000 level, it will rise to $2019, where its breach would pave the way for revisiting $2070 once again.