A group of large emerging economies called “BRICS” recently raised the idea of creating a new currency backed by gold. What is this group? Why did they spark this idea? During the gold standard phase, the yellow metal was used by governments to set a fixed price for buying and selling gold, where that fixed price was meant to decide the value of the currency. In 1971, however, U.S. President Richard Nixon surprisingly decided to ditch the gold standard system and shift to a complete fiat monetary system. Since that time, central banks’ currency reserves have combined many components, including gold and major foreign currencies such as the dollar, euro, sterling, etc. Therefore, the idea of choosing gold as a currency cover is not new. That is why BRICS countries are discussing introducing a gold-backed currency for trade and investment among member countries. In this article, we will tackle some details about BRICS countries, the objectives of the economic bloc, and how Egypt can take advantage of the introduction of the new currency.

What Is BRICS?

“BRICS” is a global economic and political group that includes major emerging economies that represent a key chunk of the global population, which are Brazil, Russia, India, China, and South Africa. In fact, BRICS is an abbreviation of the first letters of the names of the bloc’s countries in the English language.

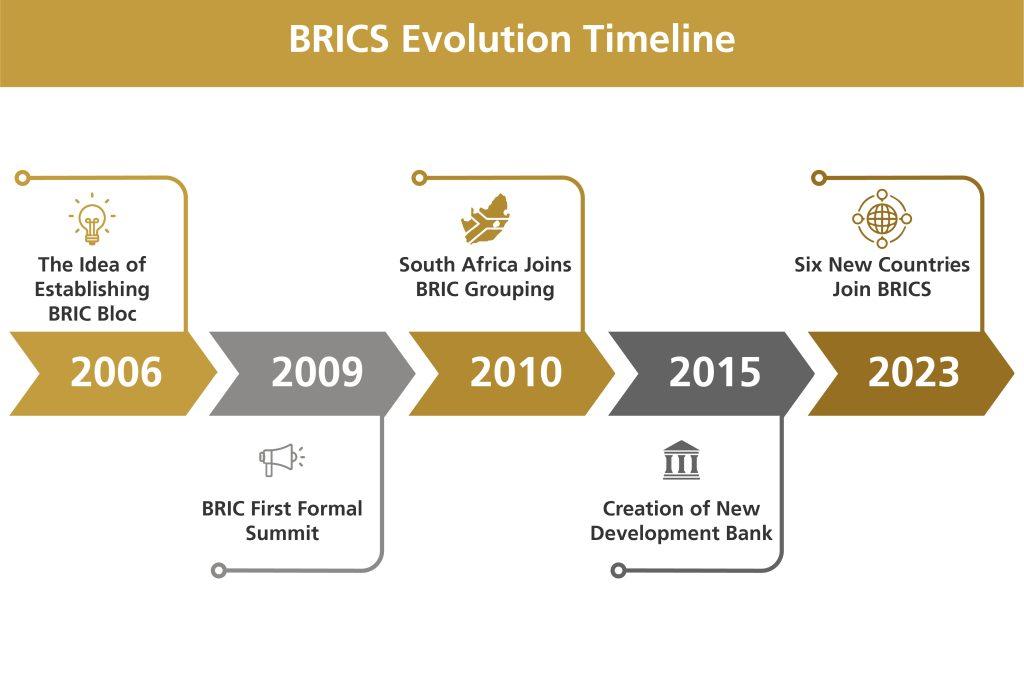

The idea of establishing BRICS began in 2006 after a series of meetings between the four founding countries: Brazil, Russia, India, and China. The first meeting was on June 16, 2009, in the Russian city of Yekaterinburg. A year later, South Africa was invited to join.

In 2015, the New Development Bank was established, with the purpose of competing with the International Monetary Fund and the World Bank in financing development projects. It should be noted that the New Development Bank is headquartered in Shanghai with an initial capital of $50 billion, divided equally among the five members, in addition to a contingency reserve fund of $100 billion to support member states that are struggling to repay debts.

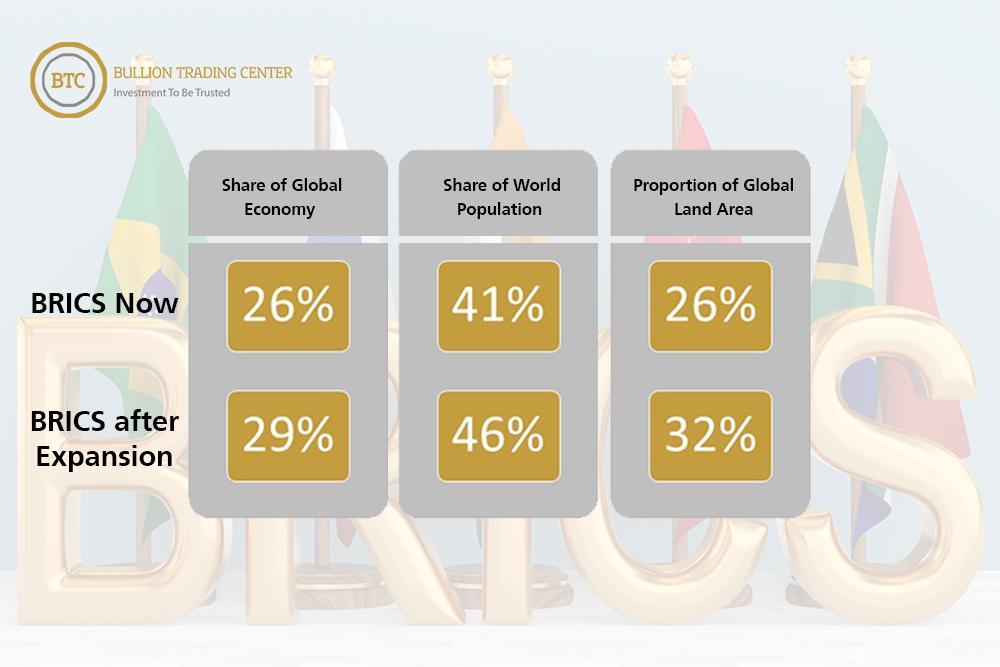

Together the countries account for 26% of the global economy, 40% of the world’s population, and more than 16% of world trade. BRICS is considered one of the most important emerging economic groups in the world and is distinguished by the diversity of their economies, as well as the enormous human, industrial, and agricultural potential. The role of BRICS has witnessed remarkable growth in the global economy over the past decade, surpassing the G7 grouping of advanced economies in terms of GDP based on purchasing power parity.

Six Countries Invited to Join BRICS

Out of more than 40 countries expressing their interest in joining BRICS, six new countries were invited to join the alliance: Egypt, Saudi Arabia, the United Arab Emirates, Argentina, Ethiopia and Iran are set to formally become members on Jan. 1, 2024.

With the enlargement of the bloc to 11 countries, the size of the group’s economy will become $29 trillion, or about 29% of the global economy, compared to $26 trillion before the admission of the new members. The group will also have a population of more than three billion and 670 million people, nearly half of the world’s population. In addition, the expanded BRICS will occupy approximately 32% of the world’s land area, after representing nearly a quarter of the world’s land area.

Among the newcomers, there are two major oil producers, Saudi Arabia and the United Arab Emirates, which will give the BRICS strong global influence in the global energy field, and would also increase integration and trade cooperation within the bloc, as both China and India are among the top oil consumers in the world.

Objectives of establishing the alliance

The BRICS alliance aims to become a global economic power capable of competing with the “Group of Seven,” which possesses 60% of global wealth, and thus the world’s economy becomes multipolar by creating an alternative to Western economic hegemony.

It also seeks to liberate the global economy from the dollar’s global governance by reducing its dominance over international trade, as well as its leading role as a global reserve currency. To achieve this goal, BRICS countries look forward to depending on local currencies in commerce between members, which also paves the way for the idea of relying on a new currency backed by gold.

Enhancing trade and investment among members, as well as achieving economic, political, and geopolitical integration, is one of the key objectives of the alliance. It also supports sustainable development and provides financing for economic development and infrastructure projects in member states by creating an effective and real alternative to the International Monetary Fund and the World Bank. Finally, BRICS seeks to provide emerging economies with a stronger voice and representation in global institutions such as the United Nations and the G20.

Discussions to create a gold-backed BRICS currency

The BRICS bloc seeks to launch a new common currency to be used in commercial transactions between member states, in light of the group’s desire to lessen dependence on the US dollar in global trade payments.

It seems that the first step will be to increase the use of local currencies in intra-trade and establish a common payment system. Then a new currency will be created, which will most likely be backed by gold. Choosing gold specifically and not any other commodity as a basis for the new currency system is meant to leverage from gold’s characteristics in order to realize stability in the value of the currency. When a currency is backed by gold this means it is possible to convert into units of gold, as was the case in the Bretton Woods agreement, when the price of the dollar was pegged at that time at $35 per ounce of gold (an ounce equals 31.10 grams).

In light of the strict sanctions imposed on Russia, which encompass complete isolation from the entire Western financial system, including the banks of the United States and the European Union and the SWIFT system for international banking payments, Moscow is keener than other members to launch this new currency. BRICS currency should become completely independent from the current system and a safe platform for multilateral cross-border settlements.

There is a high possibility that Russia will assume the rotating BRICS presidency in 2024, which has boosted speculations that it will try to accelerate the issuance of a new BRICS currency next year. Some analysts also hinted that the BRICS countries have already begun to expand their purchases of gold in order to launch the new currency as soon as convenient.

In the event of incepting BRICS currency, Egypt could benefit from its recent discovery of gold mines, as there are seven promising mines, such as the Sukari mine in the Golden Triangle, Halayeb, and Shalateen. There are also other distinct areas for gold prospecting inside Egypt, according to Naji Farag, Advisor to the Minister of Supply for Affairs.

The Central Bank of Egypt also increased the amount of gold in foreign exchange reserves during 2022 and the first quarter of this year. Egypt was the largest buyer of gold at the level of central banks during the first quarter of 2022, where it represented 29% of the total foreign exchange reserves by the end of August.